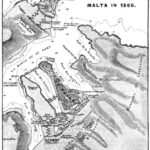

The bustling harbor towns of Birgu, Bormla, and Isla in early modern Malta offered unique opportunities and challenges for businessmen navigating their trades in an evolving economy. Between 1530 and 1630, these towns transformed into essential hubs of commerce, adapting to shifts in power and strategic needs within the Mediterranean. Here, we delve into the experiences of local businessmen during this period, supported by insights from Rachel Grillo’s research on these dynamic harbor towns.

The Growing Market Economy in Birgu, Bormla, and Isla

With the arrival of the Knights of St. John, Birgu emerged as the primary base and economic nucleus, sparking significant growth in the region. Businessmen quickly seized opportunities, setting up shops and stalls in prime locations, and offering a range of goods that spoke to the diversity and cosmopolitan nature of the population. Grillo observes that “As the towns grew, the marketplaces grew with them, and with this, a market economy was developed” (Grillo, 2023, 37). This expansion not only increased trading opportunities but also attracted merchants from across the Mediterranean, creating a competitive yet promising environment for local businessmen.

Competition soon became a defining feature of the marketplaces, compelling shopkeepers to focus on quality and pricing to secure their customers. “The early sign was the competition that was displayed in the market between different shops which sold the same commodities” (Grillo, 2023, 43). Businessmen keenly recognized this rivalry as a key influence on their success, understanding that it shaped customer loyalty and directly affected their profit margins.

Business Before, During, and After the Great Siege

The Great Siege of 1565 and the Order of St. John’s relocation to Valletta in 1571 were transformative events that shaped the economic landscape of Malta’s harbor towns. Birgu, Bormla, and Isla evolved significantly through these periods, adapting to both the threats of war and shifts in political power. See Also : Why did the knights build the three fortress stories?

Business Before the Siege

Before the Great Siege, Birgu was already a bustling commercial center, thriving as the Order’s primary base. This strategic position attracted traders, merchants, and service providers from across the Mediterranean, drawn to the security and opportunities associated with the Order of St. John. The competitive marketplace fostered economic innovation and attracted a mix of local and foreign merchants. Grillo describes how “As the towns grew, the marketplaces grew with them, and with this, a market economy was developed” (Grillo, 2023, 37). This vibrant, cosmopolitan atmosphere made Birgu the heart of a growing economy, where the diversity of goods and competitive dynamics underscored its commercial appeal. How did both sides finance the war?

Impact of the Great Siege on Business

The Great Siege, however, disrupted life in these harbor towns significantly. Birgu, Bormla, and Isla bore the brunt of the Ottoman assault, facing intense bombardment that damaged crucial infrastructure, especially in Isla. Many businesses likely suffered considerable losses as operations were interrupted or forced to downsize amidst the chaos. As Grillo notes, “Fort St. Michael experienced heavy bombardment at the cost of severe damage to the town of Isla” (Grillo, 2023, 119). Defensive strategies further compounded the economic toll, as authorities ordered demolitions in Bormla to fortify the town. “All properties in Bormla between the house of Paulo Davola and the Birgu fortifications had to be demolished within eight days,” illustrating the drastic measures taken to protect the towns, even at the expense of local livelihoods (Grillo, 2023, 93).

Despite these hardships, the towns’ resilience and eventual victory led to formal recognitions of their endurance. In the aftermath of the siege, Birgu was granted the title Città Vittoriosa, while Isla was honored as Città Invicta, reflecting the respect these towns earned for their fortitude (Grillo, 2023, 14)W

Learn more: Economics of the knights of Malta.

Business After the Move to Valletta

When the Order relocated to the newly built capital of Valletta in 1571, concerns arose that this shift might drain economic activity from the harbor towns. However, Birgu, Bormla, and Isla retained their commercial vibrancy and continued to play significant economic roles. Many merchants maintained operations in Birgu, drawn by its established infrastructure and status as a key harbor. Grillo highlights that “The market economy of Birgu, Bormla, and Isla did not suffer a blow after the relocation either, as many shops and taverns were still being licensed to operate from the towns” (Grillo, 2023, 37).

Furthermore, Birgu remained a central port for both the Order’s galleys and commercial vessels, as early plans to build an arsenal in Valletta encountered setbacks. This preserved Birgu’s importance within Malta’s trade network, underscoring the adaptability of the harbor towns. As Grillo’s study reflects, the established trade networks and sustained demand for goods allowed the local economy to remain stable even after the shift in administrative focus to Valletta (Grillo, 2023, 37).

The economic resilience of Birgu, Bormla, and Isla highlights their adaptability and strategic importance within Malta’s evolving political landscape. Despite the disruptions of war and relocation, these towns preserved their commercial vitality, reflecting the strong networks and established culture of trade that helped them thrive through turbulent times.

Running Shops and Taverns: A Social and Financial Hub

Shops and taverns weren’t just venues for business; they served as community centers, where businessmen connected with customers, travelers, and fellow merchants. Grillo notes, “The town’s taverns served as meeting places for its inhabitants, wherein people could wind down, socialise, drink, and consume food” (Grillo, 2023, 52). For businessmen, these taverns offered ideal settings to negotiate deals, expand networks, and stay informed about trends in the market.

A significant part of the population were commoners, and businessmen in taverns tailored offerings to suit varying budgets, with affordable wine options being particularly popular. Grillo explains that “the vino minuto which was sold by small measure was mostly drunk by the commoners” (Grillo, 2023, 46). Such adaptability helped cultivate a loyal clientele, essential for sustaining businesses in a competitive market.

Challenges of Commerce in the Harbour Towns

Despite the opportunities, challenges were a daily reality. The crime rate, especially in the late sixteenth century, was high due to the influx of foreign sailors and transient populations. As Grillo remarks, “Crime was more prominent in urban and cosmopolitan contexts” (Grillo, 2023, 63), highlighting the risks businessmen faced in protecting their goods and profits. Additionally, businessmen involved in lending had to manage financial risks carefully. Grillo observes that “usury in a port economy” helped support smaller tradespeople but came with high default risks (Grillo, 2023, 41). Building a reputation of trust and reliability was thus crucial for businessmen to weather the uncertainties of trade.

Here’s a revised explanation of the financial instruments, now with quotes from the document for support, written in a more human style:

Financial instruments used in early modern Malta

Especially within the bustling port towns of Birgu, Bormla, and Isla, business was more than just buying and selling goods—it was supported by a sophisticated web of financial practices and instruments that allowed for lending, investment, and trade. Here are some of the ways local businessmen managed their finances, supported by quotes from Grillo’s study.

- Usury and Money Lending

Money lending with interest, or usury, was a common practice, facilitated by local figures who could provide cash flow to those needing capital. Pietro Gallan, one of these prominent lenders, frequently appeared in notarial records. He didn’t just lend out his own funds; he also acted as a guarantor for others, like in one case where he guaranteed a sum of 20 scudi for Jorlando Grec. As Grillo explains, Gallan “appears in several contracts either as a guarantor or a direct lender,” showcasing his central role in the financial network of the harbor towns (Grillo, 2023, 112). These arrangements allowed businessmen to access funds quickly, though at a risk; for example, Grec pledged “all his possessions, including his wife’s dowry,” as collateral, illustrating the high stakes of these transactions (Grillo, 2023, 112). - Collateralized Lending

Loans in these port towns often came with collateral, a necessary safeguard for lenders. Notarial records highlight that collateral wasn’t limited to money or goods—properties and even family dowries were fair game. In Jorlando Grec’s case, using his wife’s dowry emphasized the cultural and personal weight of financial deals. This system of collateralized lending was designed to reduce risks for lenders, ensuring they could recover their investments if the borrower defaulted. According to Grillo, “the pledged assets added security to these high-interest deals, reflecting the trust-based but risk-conscious financial culture of the port towns” (Grillo, 2023, 114). - Venture Partnerships in the Grain Trade

The grain trade was a vital sector for Malta, and it offered a reliable investment opportunity for Maltese residents. These investments were often managed by the Università, the local governing body, allowing citizens to pool resources to secure grain imports, primarily from Sicily. Investors earned returns in produce, and this trade was not just essential for survival but was profitable. Grillo notes that “Maltese individuals could either invest directly or contribute funds to the Università’s procurement efforts,” which provided both financial and practical returns (Grillo, 2023, 58). By partnering in such ventures, local investors had a stake in the island’s food supply and earned a predictable return, making it a popular choice for those looking to grow their wealth. - Safe Conduct Certificates for Merchants

International trade was risky, especially for merchants operating in regions like the Maghreb or the Eastern Mediterranean. To protect their investments, some merchants carried a salvi conductus, or safe conduct certificate, which granted them legal protection while conducting business abroad. This certificate, as Grillo describes, was “essential for traders like Bartholomeo Habel,” who operated in politically unstable areas (Grillo, 2023, 83). These documents helped shield merchants from foreign legal threats, thus encouraging more Maltese traders to expand their business networks across borders. - Notarial Services and Debt Settlements

Local notaries were indispensable in formalizing financial agreements and ensuring clear, enforceable terms. For instance, Franciscus Rochion, a well-known moneylender, frequently appeared in debt contracts, charging interest that could sometimes lead to disputes. Grillo mentions that “Rochion’s reputation for high-interest loans sometimes drew scrutiny,” but notarial contracts added legitimacy to his transactions, creating a structured financial environment (Grillo, 2023, 106). These notarial services allowed both lenders and borrowers to navigate their obligations in a system where disputes could arise but were controlled through documented agreements.

These financial tools and practices reveal a structured, trust-based economy in Malta’s port towns, where lending and investment were integral to business life. Local notaries, collateral requirements, and partnerships in essential trades like grain helped create a stable, albeit high-risk, financial landscape that sustained these thriving commercial hubs.

Settling Business Disputes

In early modern Malta, the Castellania was central to enforcing contracts and resolving business disputes. Located in Birgu, the Castellania was the main law court responsible for handling civil and criminal cases. Grillo describes how it served as a structured legal forum where disputes between merchants and residents could be formally addressed. “The Castellania, operating as the central court in Birgu, documented cases in Latin and Italian, beginning with the identification of the plaintiff and defendant, followed by a case summary and witness testimonies” (Grillo, 2023, 107). This court maintained a strict process, where both parties were interrogated, and the judge issued final rulings based on documented evidence, which helped enforce contracts and settle disputes.

Notaries also played a significant role in the contractual landscape, often drafting and witnessing agreements to ensure they held legal weight. For example, prominent notaries like Franciscus Rochion and Vincenzo Bonaventura de Bonetiis formalized various business transactions, debt settlements, and collateral agreements, giving these contracts a legal foundation. According to Grillo, “Notaries were indispensable for drafting contracts, especially in lending practices, where terms often included repossessing collateral in case of default” (Grillo, 2023, 89). These notarized agreements provided both parties with a formal basis for legal recourse if disputes arose.

For more complex disputes or larger financial cases, the local Università (municipal body) sometimes intervened, especially if the dispute threatened the town’s economic stability or reputation. Businessmen depended on formal legal procedures in these instances, as Grillo notes: “The Università occasionally stepped in for conflicts that involved significant stakes or jeopardized the communal reputation, adding a layer of authority to resolutions” (Grillo, 2023, 92).

These structures—the Castellania, the notarial system, and occasionally the Università—formed a robust framework for resolving disputes and ensuring contract enforcement, giving the harbor towns a reliable foundation for business transactions.

Conclusion

The harbor towns of Birgu, Bormla, and Isla presented a distinct economic landscape for businessmen in early modern Malta. Despite the challenges of intense competition, high crime rates, and significant events like the Great Siege and the Order’s relocation to Valletta, businesses in these towns adapted and thrived. Their persistence not only contributed to the resilience of Malta’s southern harbor economy but also maintained these towns as vibrant centers of trade and community life, even as the island itself evolved. As the world moved on and the seas saw more peace, Malta’s economy also changed…

References:

Grillo, R. (2023). The early modern history of the Maltese harbour towns: Birgu, Bormla and Isla from 1530 to 1630. Available online